BTC Price Prediction: Navigating Key Technical and Macro Crosscurrents

#BTC

- Technical Crossroads: BTC tests critical MA and Bollinger Band levels amid bearish MACD momentum

- Institutional Dichotomy: Growing adoption (Bitwise/Metaplanet) vs macro headwinds (Fed policy)

- Cycle Timing: Historical patterns suggest decisive price action likely within 100 days

BTC Price Prediction

BTC Technical Analysis: Key Indicators and Trends

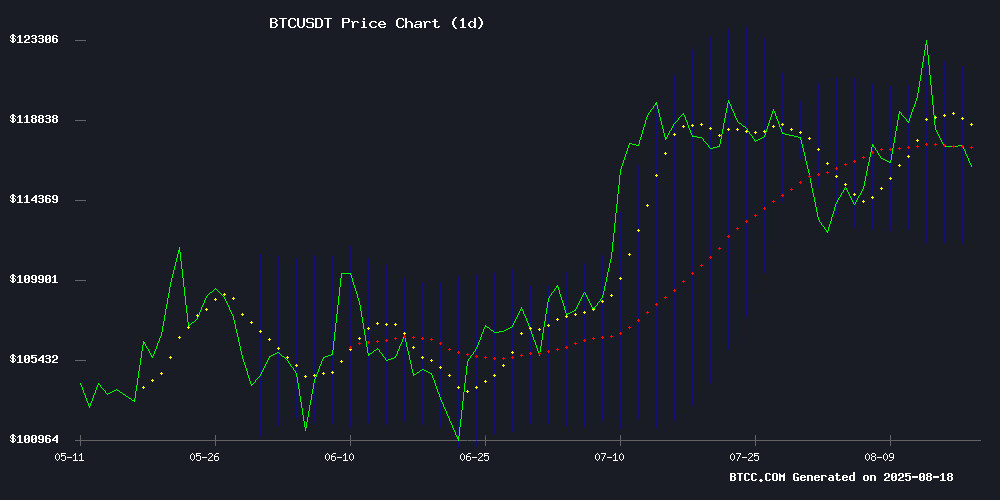

According to BTCC financial analyst James, Bitcoin (BTC) is currently trading at 115,865.92 USDT, slightly below its 20-day moving average (MA) of 116,807.64. The MACD indicator shows a bearish crossover with values at -1,206.14 (MACD line), -49.83 (signal line), and -1,156.30 (histogram). Bollinger Bands suggest a neutral-to-bearish sentiment, with the price hovering near the middle band (116,807.64), while the upper and lower bands stand at 121,718.49 and 111,896.78, respectively.

James notes that the current technical setup indicates short-term consolidation, with potential downside risks if BTC fails to hold above the 20-day MA. A break below the lower Bollinger Band could trigger further selling pressure.

Market Sentiment: Mixed Signals Amid Macro Uncertainty

BTCC financial analyst James highlights conflicting market signals from recent news. While institutional interest grows (e.g., Bitwise advocating crypto's "liquid alpha" and Metaplanet's bitcoin accumulation plan), macroeconomic concerns persist due to fading Fed rate cut hopes. Regulatory developments (South Korea's tax probe, Thailand's crypto tourism push) add complexity.

James observes that the "Crypto Market Greed" sentiment aligns with technical resistance levels, suggesting traders should watch for potential profit-taking NEAR $118,000 resistance.

Factors Influencing BTC’s Price

Bitcoin Faces Potential Selling Pressure Amid Distribution Phase on Binance

Bitcoin's brief rally to a new all-time high of $124,000 on August 14 was swiftly followed by a sharp correction, with prices tumbling to $118,000. The cryptocurrency has since struggled to regain momentum, trading sideways over the weekend.

On-chain data reveals a concerning trend: Bitcoin's netflow on Binance has turned positive while outflows have diminished. This suggests the market may be entering a distribution phase, where holders are offloading assets rather than accumulating. Such conditions typically precede extended periods of volatility.

CryptoQuant analyst BorisVest warns this pattern could sustain selling pressure for 1-2 weeks. Exchange reserve metrics corroborate the thesis, showing increased coin deposits on the world's largest trading platform. When whales MOVE coins to exchanges, it often signals impending sell orders.

Fading Fed Rate Cut Hopes: Is a Bitcoin Price Drop Next?

Bitcoin retreated below $117,000 after briefly surpassing $124,000, as hotter-than-expected inflation data tempered expectations for Federal Reserve rate cuts. Markets now anticipate only two reductions this year, down from three.

The cryptocurrency market's volatility intensified last week amid shifting macroeconomic indicators. Core CPI and Supercore CPI—key measures of underlying inflation—showed concerning acceleration, particularly in service sector prices. This undermines the narrative of imminent monetary easing.

While initial reaction to July's CPI report appeared positive, deeper analysis revealed persistent inflationary pressures. The data suggests the Fed may maintain higher rates for longer, creating headwinds for risk assets like Bitcoin.

South Korea’s Jeju Concludes Crypto Tax Evasion Probe, Seizes Digital Assets

Jeju City authorities have wrapped up a sweeping investigation into nearly 3,000 residents suspected of tax evasion through cryptocurrency holdings. The probe, which targeted individuals with unpaid tax bills exceeding 1 million won ($719), uncovered 19.7 billion won ($14.2 million) in arrears.

Officials Leveraged South Korea's legal framework to obtain customer data from major exchanges including Upbit, Bithumb, Coinone, and Korbit. Bitcoin and other cryptocurrencies were seized from dozens of delinquent taxpayers.

The crackdown highlights growing regulatory scrutiny of digital assets in South Korea, where authorities are increasingly treating crypto as taxable property. Jeju's island jurisdiction, often seen as more lenient than mainland regulations, appears to be aligning with national enforcement trends.

Bitwise Urges Institutions to Reconsider Crypto's Liquid Alpha Advantage

Bitwise Asset Management's Jeff Park challenges traditional investment frameworks, arguing that crypto's unique liquid alpha opportunities are being overlooked by institutional players. Drawing parallels to David Swensen's endowment model, Park highlights a fundamental divergence: crypto rewards short-term liquidity rather than long-term lockups.

"In crypto, the term structure operates in backwardation," Park asserts. Investors are overcompensated for near-term exposure compared to traditional illiquid alternatives. Market-making strategies yielded 70% annualized returns during April 2024's volatility, while arbitrage opportunities delivered 40% - performance metrics that defy conventional portfolio theory.

Bitcoin’s Four-Year Cycle Under Scrutiny as Analyst Predicts Eventful 100 Days Ahead

The debate over Bitcoin’s four-year cycle intensifies as the cryptocurrency defies historical patterns with multiple all-time highs in 2024. Institutional inflows from spot ETFs have introduced new market dynamics, challenging traditional cyclical theories.

Frank Fetter, a market analyst, posits that if the four-year cycle holds, Bitcoin could reach its cycle peak within the next 100 days. His analysis leans on the Bitcoin Index Performance chart, which tracks BTC’s price movements across four-year epochs.

ETF adoption has undeniably altered investor composition, but Fetter’s framework suggests legacy patterns may still influence price action. The coming quarter could test whether institutional participation harmonizes with—or disrupts—Bitcoin’s historical rhythms.

Bitcoin Exhibits Uncharacteristic Calm Ahead of Pivotal Fed Events

Bitcoin's price action has entered a phase of remarkable stability, with volatility plunging to October 2023 levels. The cryptocurrency currently trades at $117,600, maintaining a tight consolidation pattern despite typically thin weekend liquidity. Market observers note the absence of speculative excess—a stark contrast to previous cycles dominated by retail frenzy.

Institutional participation appears to be reshaping Bitcoin's market dynamics. The volatility index now hovers at just 1.02%, barely double gold's fluctuation range. This compression occurs as traders await critical macroeconomic catalysts, including Wednesday's FOMC minutes release and upcoming Jackson Hole symposium. The subdued activity may represent a temporary lull before renewed momentum.

Metaplanet Aims to Acquire 1% of Bitcoin Supply by 2027

Metaplanet, a leading Japanese investment and consulting firm, has unveiled an ambitious plan to accumulate 1% of the total bitcoin supply by 2027. CEO Simon Gerovich revealed the company currently holds 18,113 BTC, valued at approximately $2.1 billion, with a roadmap targeting 30,000 BTC by 2025 and 210,000 BTC by 2027.

The aggressive accumulation strategy has already transformed Metaplanet's balance sheet, catapulting its market capitalization from $14 million in April to multibillion-dollar status. Gerovich emphasized the firm's commitment to daily execution against this long-term goal, signaling a bold institutional bet on Bitcoin's scarcity value.

Thailand to Allow Tourist Crypto Spending via Digital Baht Conversion

Thailand's financial regulators are launching a cryptocurrency payment system for foreign tourists, aiming to revitalize a sluggish tourism sector. The TouristDigiPay initiative, effective August 18, will permit visitors to convert Bitcoin and other digital assets into Thai baht for QR-code-based transactions at merchants.

The scheme requires dual registration with licensed crypto platforms and e-money providers under joint oversight by the Bank of Thailand and securities regulators. Strict KYC-AML protocols will govern participation, with cash withdrawals explicitly prohibited to mitigate financial crime risks.

This move follows the SEC's recent public consultation on digital assets' economic potential, concluding just five days before implementation. Tourism authorities view crypto payments as a strategic tool to counter declining visitor numbers, though the program initially excludes domestic retail participation.

Bitcoin Price Holds Steady Near $118,000 as Traders Eye Key Support Levels

Bitcoin's price trajectory remains a focal point for traders after reaching a new all-time high above $124,100. The cryptocurrency has since retreated to hover around $118,000, with market participants closely monitoring critical support levels that could dictate its next move.

Analyst Ali Martinez identified $117,500 and $114,500 as pivotal thresholds based on cost-basis distribution data. These levels represent significant clusters of investor entry points, suggesting potential areas of buying interest if tested. The CBD heatmap methodology reveals where accumulation has historically occurred, providing insight into possible price reactions.

Market sentiment appears cautiously optimistic despite the recent pullback from record highs. The stability around current levels suggests institutional investors may be using the consolidation phase to establish positions before the next potential leg up.

How to Make Money During a Recession With Crypto

Economic downturns often drive investors away, but seasoned market participants view recessions as opportunities to position for the next bull cycle. Cryptocurrencies, with their notorious volatility and asymmetric upside, offer unique avenues for wealth creation during these periods. While uncertainty deters the timid, disciplined strategies like dollar-cost averaging (DCA) can transform market turbulence into advantage.

Bitcoin exemplifies this approach—investing fixed amounts at regular intervals smooths out entry points and neutralizes emotional decision-making. The method's simplicity appeals to newcomers, requiring neither technical expertise nor precise market timing. Meanwhile, projects like MAGACOIN FINANCE are drawing attention from investors anticipating outsized returns, with some analysts projecting 90x gains for early entrants.

Crypto Market Greed Surges with Bullish Sentiment

The crypto market is witnessing a resurgence of bullish momentum as the Fear and Greed Index climbs sharply. The index jumped from 56 (Greed) to 64 (Greed) in just 24 hours, signaling heightened risk appetite among traders and investors. This aggressive shift underscores growing confidence in digital assets, with participants accumulating positions ahead of potential rallies.

Market psychology continues to lean optimistic, as measured by the Fear and Greed Index's scale from Extreme Fear (0) to Extreme Greed (100). Today's reading of 64 reflects a notable uptick in enthusiasm, though it remains slightly below last week's 69 and last month's 73. The trend aligns with positive price action across Bitcoin and major altcoins, reinforcing broader market confidence.

How High Will BTC Price Go?

James projects two scenarios based on current data:

| Scenario | Trigger | Price Target | Timeframe |

|---|---|---|---|

| Bullish | Break above 20-day MA & upper Bollinger Band (121,718 USDT) | 130,000-135,000 USDT | 3-6 weeks |

| Bearish | Break below lower Bollinger Band (111,896 USDT) | 105,000-108,000 USDT | 2-4 weeks |

Key watchpoints include Fed policy signals and institutional flows. The four-year cycle analysis suggests heightened volatility in coming months.

115,865.92 USDT

121,718 USDT

111,896 USDT